Where travel agents earn, learn and save!

News / European airlines hit by new lockdowns, economic contraction

Renewed lockdowns hit demand for air travel both directly and through weaker economies

November 6 - A number of European countries, including France, Germany, UK, Italy, Belgium, Ireland and Greece have reintroduced lockdown-like restrictions in response to sharply rising COVID-19 case numbers. This will hit economies: a survey of economists by the Financial Times (November 2, 2020) predicts eurozone GDP growth of -2.3% in 4Q2020, reversing the 3Q2020 rebound.

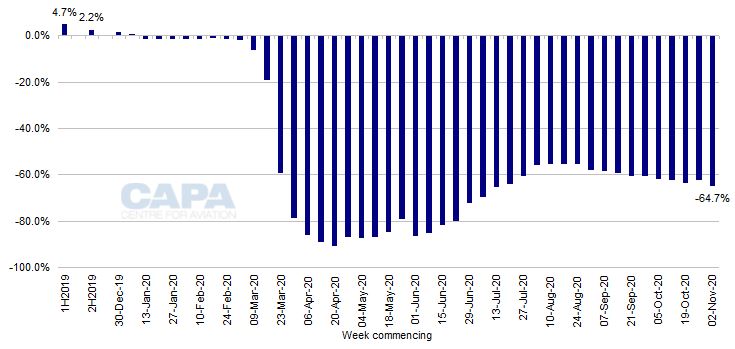

Aviation capacity continues to suffer as a result. Europe’s year-on-year cut in seat capacity widened to -64.7% in the week of 2-Nov-2020, versus -62.1% the week before.

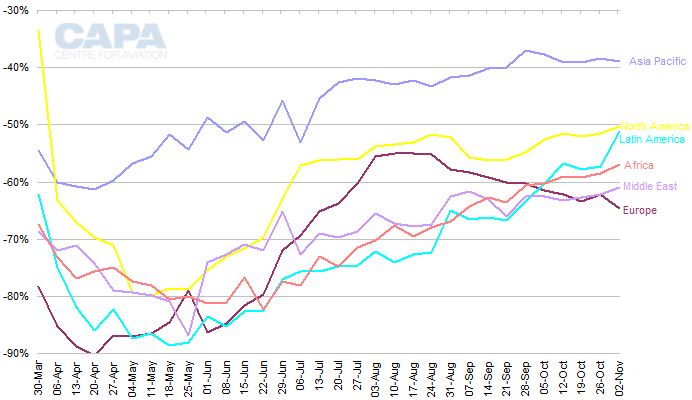

This is the biggest reduction in capacity of all the world’s regions, 3.8ppts below Middle East, on -60.9%. Africa is -56.9%, Latin America -51.2%, North America -50.2%, and Asia Pacific is -38.9%.

Moreover, the outlook for European aviation is that it will get worse before it gets better. Monthly capacity in Europe recovered from 10% of 2019 levels in April 2020 to what turned out to be a peak of 55% in August 2020. Based on filed airline schedules, it is set to fall for the third month in a row in November 2020, to 37%.

Lockdowns and economic contraction could take it lower still.

Europe: 10.1 million seats vs 28.6 million a year ago – down 65%

Total European seat capacity is scheduled to be 10.1 million in the week of November 2, 2020, according to schedules from OAG combined with CAPA Fleet Database seat configurations.This is a 10.2% decrease week-on-week (the biggest week-on-week decrease since June 2020) and 64.7% below the 28.6 million seats of the equivalent week a year ago (the biggest year-on-year decrease since July 2020).

The 64.7% year-on-year cut in total seats this week is the 33rd week of very heavy double digit percentage (more than 50%) declines in seats.

Moreover, it is 2.5ppts narrower than last week’s 62.1% drop, resuming the deteriorating trend that ran for nine successive weeks until last week’s brief narrowing of the year-on-year percentage cut.

This week’s total is split between 4.3 million domestic seats, versus 7.4 million last year; and 5.8 million international seats, versus 21.3 million.

Europe’s domestic seats have been cut by 41.5% year-on-year, compared with last week’s -37.1%. This was the 11th successive downward step and the biggest drop since Jul-2020, but still the 19th week running with domestic capacity at more than 50% of last year.

International seat capacity fell by 72.7%, compared with last week’s -70.2%.

Both international and domestic capacity fell week-on-week, for the 10th week in a row. Domestic seat numbers fell by 5.8% and international capacity plummeted by 13.2% week-on-week.

Europe: year-on-year percentage change in airline seat capacity, 1H&2H2019 and weekly in 2020

Europe has the deepest year-on-year capacity cuts

Europe's 64.7% decline is once more the deepest year-on-year cut in seat numbers of all the world regions. Middle East, which was equal bottom with Europe last week, has narrowed its cut to 60.9% this week.Africa’s seat count is down by 56.9%, Latin America’s by 51.2%, North America’s by 50.2% and Asia Pacific’s by 38.9%.

Asia Pacific has now had 17 consecutive weeks at more than 50% of last year’s capacity. It is still the only region above this threshold, although it has been fairly stagnant for the past four weeks.

North America is now only fractionally short of this threshold, while Latin America has taken a big step towards it.

Latin America, North America and Middle East narrowed their rate of year-on-year decline this week, while Asia Pacific took a very slight downward movement. Only Europe took a clearly negative step in significantly widening the rate of decline.

Year-on-year percentage change in passenger seat capacity by region, week of March 30, 2020 to week of November 2, 2020

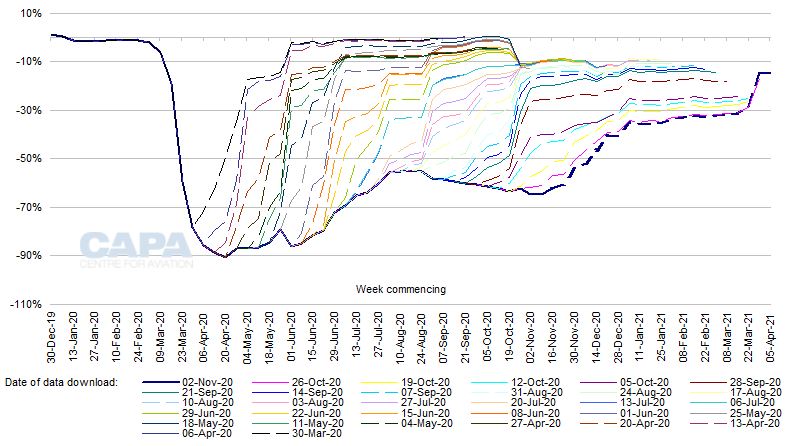

In November 2020 monthly capacity in Europe is set to fall for the third month in a row

Projected capacity derived from OAG schedules for November 2020 is down by 10% compared with last week and is projected to be down by 63% year-on-year, i.e. at 37% of November 2019 levels.This outlook for November 2020 is now below the out-turn for October 2020, which reached 38% of last year’s levels, itself a deterioration from September 2020’s 41% and August 2020’s 45%.

Schedules for the rest of winter 2020/2021 have further to fall

December 2020 capacity has been lowered by 7% since last week, but is still projected to be at 51% of 2019 levels.Capacity for the first two months of 2021 has been lowered by only 1% since last week and is still scheduled to be at 64% of prior year seat numbers in January 2021, and at 68% in February 2021.

CAPA has previously predicted that Europe is unlikely to have more than 40% of 2019 capacity (or 25% of passenger numbers) in the winter 2020/2021 season.

See related report: Europe’s winter traffic <25% of last year. Expect airline bankruptcies

This prediction may need further downward revision in the light of renewed lockdown restrictions in much of Europe. Capacity projections over the winter months derived from schedules currently filed with OAG are significantly ahead of this, and will inevitably fall further.

Europe: percentage change in airline seat capacity vs equivalent week of 2019, with outlook at different dates*

*Note: dashed lines indicate future data as anticipated at the date of download indicated.

Source: CAPA - Centre for Aviation, OAG.

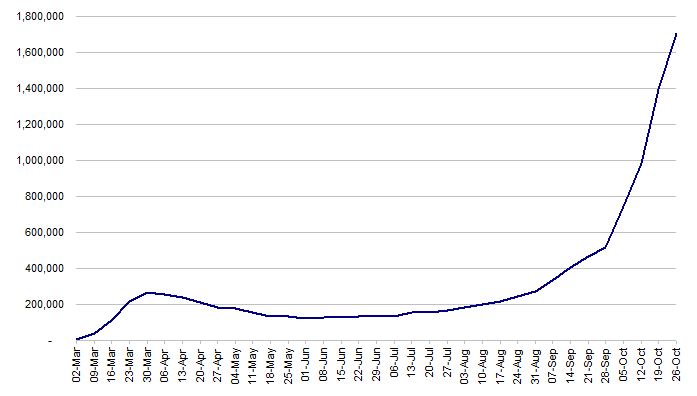

Europe's weekly COVID-19 case numbers have more than tripled in the past month

The reintroduction of lockdown restrictions in France, Germany, UK, Italy, Belgium, Ireland, Greece and other parts of Europe follows persistent growth in the number of weekly cases of COVID-19 across the continent since early June 2020.Figures from the World Health Organisation show that confirmed cases in Europe bottomed out at 122,527 in the week of June 1, 2020. This was well under half of the first wave peak of 264,369 in the week of March 30, 2020.

However, numbers have risen consistently since then in the second wave, surpassing the previous peak in late August 2020.

In the week of October 26, 2020, there were more than 1.7 million confirmed COVID-19 cases in Europe. This was 3.3 times the number recorded for the week of September 28, 2020, only one month earlier, and more than in any other region reported by the WHO.

The number of deaths has not risen as sharply. At 17,129 in the week of October 26, 2020, the number was still below the peak of 28,784 recorded in the week of April 6, 2020.

Nevertheless, this statistic has consistently grown every week since the week of August 17, 2020, and is also more than three times the figure reported for the week of September 28, 2020.

Europe: weekly numbers of confirmed cases of COVID-19

The resurgence in COVID-19 cases in Europe has been attributed to the easing of previous restrictions within countries in order to boost economic activity, the cross-border movement of summer seasonal workers, and the return of students to schools and university campuses.

International travel by holiday makers has also been cited as a contributory factor and this includes air travel – in spite of the various quarantines and other travel restrictions that European nations have variously imposed.

This highlights the lack of potency of this web of restrictions without a widespread and effective testing regime for air travellers.

European economies may shrink again in 4Q2020

The flash IHS Markit Eurozone Composite Purchasing Managers' Index (PMI) fell from to 50.4 in September 2020 to 49.4 in October 2020, which was the third consecutive monthly drop. A PMI figure below 50 signals a contraction of business activity, the first since June 2020.The flash index was published on October 23, 2020 and based on data collected in the two weeks beforehand – before the renewed lockdowns in many European countries. Even before the additional negative impact of the lockdowns, the index was a sign that the region’s economy could contract again in 4Q2020.

Indeed, according to a survey of economists by the Financial Times (November 2, 2020), the eurozone economy is expected to shrink by 2.3% in 4Q2020, cutting output by EUR68 billion – worse than predicted before the new restrictions.

This would follow a bounce-back in 3Q2020, when GDP grew by 12.7%. This was a record growth rate for the eurozone, although the economy was still well below pre-pandemic size.

Renewed lockdowns hit demand for air travel both directly and through economic damage

The uncertainties created by frequent changes in travel restrictions and quarantine rules have already had a detrimental impact on passenger demand for aviation since the August 2020 recovery peak.The new lockdown restrictions vary in different countries of Europe but, in a number of them, will almost totally shut down passenger demand – as happened after the first lockdowns.

For example, detailing new national restrictions for England from November 5, 2020, the UK government website says: “Overnight stays and holidays away from primary residences will not be allowed. This includes holidays abroad and in the UK”.

In France, holiday travel is not a permitted reason for people to leave their home during the new lockdown from 3October 30, 2020, at least till December 1, 2020. Spain began a national curfew on October 25, 2020, which includes restrictions on any journeys that are not for work, buying medicine or caring for the elderly or young.

In Germany, all non-essential travel is strongly discouraged until November 30, 2020. Italians are strongly advised not to leave their immediate areas unless for work, study or health reasons.

Moreover, the impact of the second wave and the consequent lockdowns is negative for the continent’s economic outlook, with the impact potentially lasting beyond the time frame of the lockdowns.

Added to the direct effect of lockdowns on demand for air travel will be the additional negative impact of weaker economic growth.

More Travel News:

St. Vincent and the Grenadines announces interim entry requirements for vacationers

New Travel Agency Commissioners Announced

UNWTO and IMO join call to support safe resumption of cruise ship operations

What will 2021 hold? G Adventures is thinking adventure