Where travel agents earn, learn and save!

News / IATA forecasts devastating outlook for Asia's aviation

IATA's forecasts for 2022 suggest serious problems ahead for Asian aviation and tourism

There is increasingly a sense that the ‘worst is behind us’ for the airline industry – and certainly there is cause for some optimism in the US as the winter holiday season approaches, and across the Atlantic, as vaccinated travel opens up.

But in the enthusiasm of a rush for freedom, we need to be cautious and recognize that, as an industry, there are serious challenges ahead. There will be no going back to the industry as we knew it.

CAPA Live on October 13, 2021 highlighted IATA's recently released forecasts for 2022’s international aviation markets. They are little short of shocking.

Clearly, forecasting is difficult at this time, but as the most reputable and generally impartial forecasts, the scenario that the IATA predictions paint is startling.

In 2022, the third year into the pandemic, the average that emerges predicts at best an anaemic international travel market recovery next year, relative to the pre-pandemic days.

To watch all the sessions from CAPA Live October, on demand, visit: centreforaviation.com/analysis/video.

IATA's forecasts for 2022 suggest serious problems ahead for Asian aviation and tourism

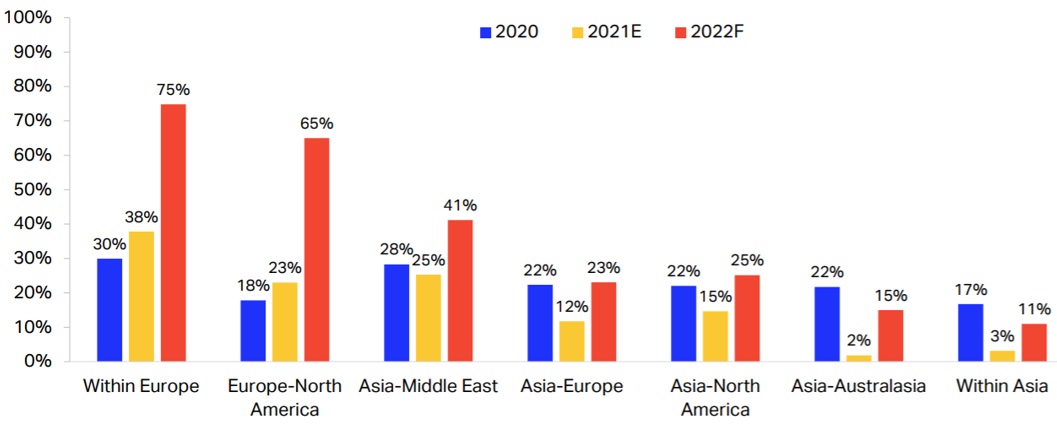

IATA regional forecasts of main international routes: RPKs, percentage of 2019 levels

Source: IATA Economics Airline Industry Financial Forecast update, October 2021

Asia comes out of this set of IATA's forecasts looking by far the worst region in 2022. ‘Within-Asia’ traffic (RPKs) is forecast to be still nearly 90% below 2019 levels for the full year 2022 – that is, effectively negligible improvement from the present position.

And beyond Asia, to the Middle East, to Europe, to North America, and to Australasia – even these key international markets are still projected to be massively down, either in the teens or low twenties percentage of 2019 levels.

From the present perspective, forecasting future growth from such a low base is difficult at best, with a host of "unknown unknowns". Yet, even if these forecasts prove to be 100% wide of the eventual outcome, the outlook remains far from any ‘new normal’ – any new normal that is, that can support the levels of air service needed to sustain the industry.

This would be an unwelcome extension to the two incredibly tough two years just past and speaks to a totally changed global aviation landscape.

If these forecasts play out, it will have a massive impact on airline revenues and, of course, the tourism industries that are vital economic drivers in most of the countries in the region.

Before the coronavirus pandemic the Asia Pacific region accounted for about a third of global RPKs, but in 2022 the region will now remain approximately three-quarters below Europe, and North America.

For the airlines operating in and to/from the Asia Pacific region, that message is seriously concerning. The region has been holding its breath for 18 months and, according to IATA’s forecasts, is now looking down the barrel of another whole year of weak passenger demand.

Even demand in the North Atlantic, in Europe to North America, where optimism is high, is still anticipated to be a third lower than pre-pandemic levels.

The global RPK forecast for 2022 is down 40% on 2019

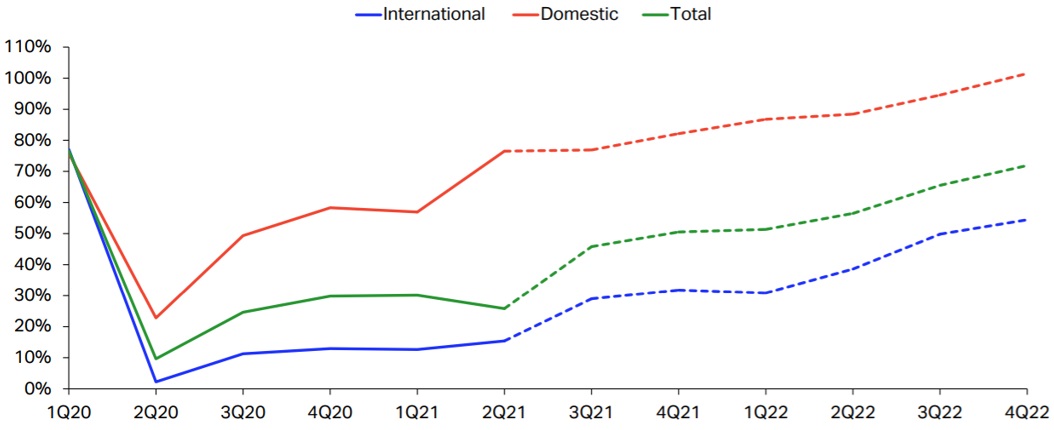

Measured in RPKs, total global air traffic demand for 2021 is expected to stand at around 40% of 2019 levels, rising to approximately 60% of 2019 in 2022.

(Domestic markets accounted for 36% of total worldwide air traffic (RPKs) in 2019, but rose to more than 54% in CY2020 and have held at this proportion through 2021).

IATA forecast of international vs domestic (and total) global traffic (RPKs): quarterly as percentage of 2019

Source: IATA Economics Airline Industry Financial Forecast update, October 2021

That is a massive drop from where it was previously, especially in the context of razor-thin industry margins and prior demand shocks in the 5%-10% magnitude (and of shorter duration).

The impact on airline revenues will be extreme

The impact of this steep fall on airline revenues, on profitability, and in fact on the very existence of many airlines, is going to be dramatic.

The ramifications are also being felt on the various parts of the industry that rely on the airlines for their revenues. The air navigation service providers, the airports and a whole array of others are hurting and (often) have not benefitted as much as the airlines from state support.

But what's happening now, as we start to see some recovery, particularly in Europe and North America, is that air navigation service providers are looking to recoup some of those massive losses. IATA is anticipating – and loudly protesting – something like a USD2.3 billion charges increase during this crisis.

The annual profitability of the airline industry, as a whole, over the past 75 years has generally wavered somewhere between plus or minus USD5 billion. So, just for air navigation service providers to have a USD2.3 billion increase in charges is a massive impost.

Another negative factor for the industry is the simple fact that many airlines are already in such a drastic debt and revenue condition.

Through the pandemic airlines will have racked up USD200 billion in losses – not something that can be readily absorbed. And the airline industry’s debt load has also soared by around USD200 billion. According to some experts this debt level is not expected to return to pre-pandemic debt levels till early next decade, which is a dangerous overhang with the prospect of medium term interest rates rising for all but the most successful airlines.

Border crossings are the biggest suppressant of travel

Internationally, perhaps the biggest suppressant of travel is going to be border crossings. As IATA Director General, Willie Walsh, said at the recent AGM, "The biggest deterrent to their travel continues to be quarantine measures in various forms". And it's not just those measures.

It's the variability and uncertainty of the restrictions that are making life very difficult for the operators and would-be travellers. There is such residual uncertainty now among the travelling public that is certainly going to be a deterrent to travel long after the issues are resolved.

Undoubtedly there is going to be a large minority that cannot wait to get back into the air, but the residual gap between projected revenues and profitability looks to be enormous.

Time to rethink an industry that is irreversibly changed

This all points to a changed industry in need of fresh thinking.

Many things are going to have to be done differently, by governments, by airlines, by everyone who's involved in the aviation supply chain, and particularly in Asia, where the COVID impact has been particularly deep and extended.

Perhaps, as this scenario becomes more visible, governments – and the industry itself, where a presumption of recovery to the old ways seems to prevail – will need to refocus on what is possible. Not on what is hoped for.

At present the gap between the two is wide.