Where travel agents earn, learn and save!

News / COVID testing of air travellers – could be the last straw

The cost of testing is adding unacceptable burdens on air travel

May 19 - ‘A new brush sweeps clean’, as the saying goes, and it hasn’t taken forthright airline personality Willie Walsh long to put down a marker as the new Director General of IATA.

Mr Walsh’s target of the week is the rising and unacceptable cost of PCR testing for the coronavirus, which is adding such a burden to the price of airline tickets that it is making air travel simply unattractive to far too many people. Air travel is in danger of becoming once again the preserve of the rich with too much time on their hands.

Leisure travel faces a bleak future, and business travel doesn’t look like it will pick up sufficiently to cover the leisure losses.

Mr Walsh, who was interviewed in CAPA Live this month (May 12), wants governments to pick up the bill for testing that is a World Health Organization regulation, but that is hardly on the cards while those governments struggle with mounting debts and borrowing requirements; and decline to reduce aviation taxes. (At least one group airport operator – the biggest in the world, mind – wants to increase charges!)

COVID-19 testing costs are “putting travel out of family reach”

The International Air Transport Association (IATA), along with other industry bodies, has been accused of being slow to react to the implications of the pandemic for the industry.

However, with a new ex-airline and group CEO – the outspoken Willie Walsh – at its helm since the start of April 2021, things might be changing, as evidenced by a statement made by its new Director General at the beginning of May 2021.

In that statement IATA called on governments to ensure that high costs for COVID-19 testing do not “put travel out of reach for individuals and families”. IATA stated that to facilitate an efficient restart of international travel, COVID-19 testing must be affordable, as well as timely, widely available and effective.

Average testing cost now USD150 per person: ‘States should not be charging” (WHO)

According to an IATA sampling of 16 countries where there is a cost for PCR testing to the individual, the average minimum cost for testing was USD90 and the average maximum cost for testing was USD208. (Making an average overall cost of USD150 per person, which is probably more than the typical traveller would expect to pay in travel taxes, at least, for journeys not in excess of three to four hours within continents. And those taxes aren’t going away, either.)The World Health Organization’s (WHO) International Health Regulations stipulate that states should not charge for testing or vaccination required for travel, or for issuing certificates.

Mr Walsh said the “best solution is for the costs to be borne by governments” as testing is “their responsibility under WHO guidelines”. IATA stated that of markets surveyed, France represented the best practice: France bears the cost of testing, including tests to facilitate travel.

IATA insists that even taking the average of the low-end cost (USD90), adding PCR testing to airfares would dramatically increase the cost of flying for individuals.

Pre-crisis, the average one-way airline ticket, including taxes and charges, cost USD200 (2019 data). A USD90 PCR test raises the cost by 45%, to USD290. Add another test on arrival, and the one-way cost would leap 90% – to USD380.

Assuming that two tests are needed in each direction, the average cost for an individual return trip could balloon from USD400 to USD760. And, again, that does not take into account tax increases either.

Ticket price increase, swollen by COVID test costs, outstrips inflation by 26 times

That increase, 400 to 760, is an inflation rate of 90%.

In 2019 the global inflation rate was 3.51%; in 2020 3.18%, and the projection for 2021 is 3.39%. (Source: Statista). The air ticket inflation rate would therefore be 26.5 times that of global inflation in 2021. Who in their right mind is going to pay that?

And it gets worse. The impact of the costs of COVID-19 testing on family travel would be even more severe. Based on average ticket prices (USD200) and average low-end PCR testing (USD90) twice each way, a journey for four that would have cost USD1,600 pre-COVID could nearly double, to USD3,040 – with USD1,440 being testing costs.

Onus falls on business travel, but there are few takers for that

What IATA does not say (it is not really in its interests to point this out) is that such increases would put leisure travel with any reasonable frequency out of the reach of all but the very well financially heeled.

They would place air journeys instead in the domain of the business traveller – a species which has already declared that it is far less willing to travel than it was previously, and one that has adopted applications like Zoom and Microsoft Teams (and whatever further enhanced products follow them) as if they were the ‘Second Coming’.

In other words, air travel would revert to being the preserve of the rich.

Below are various observations from the weekly CAPA CEO Briefing, from May 10, 2021:

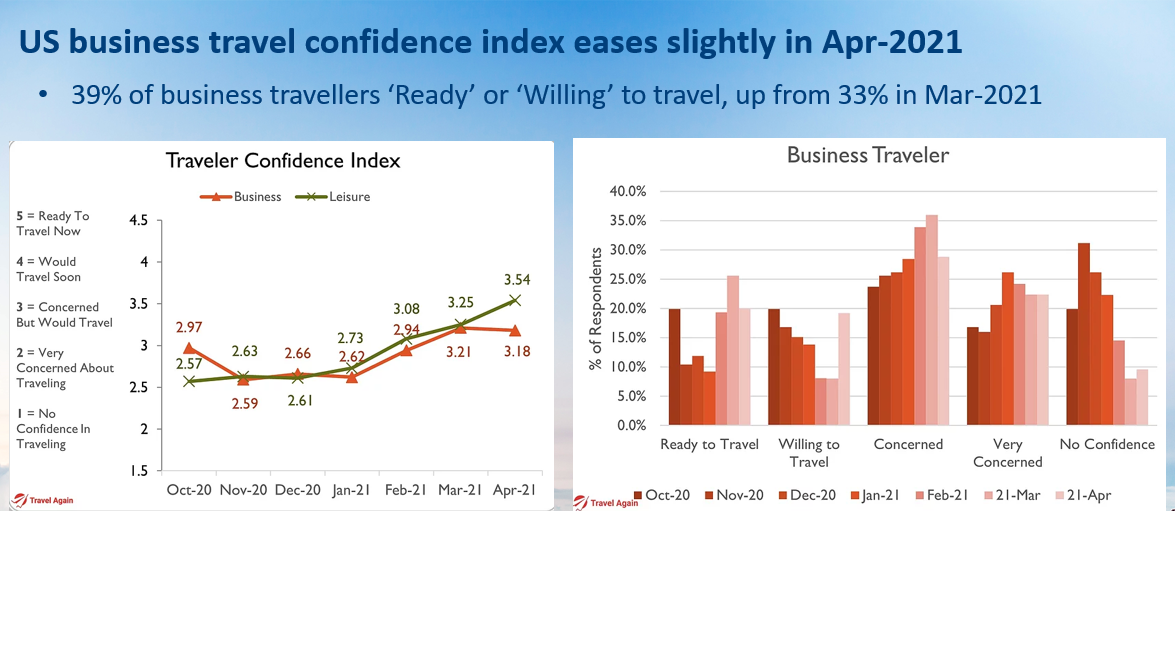

• In the U.S. 39% of businesses said they were ‘ready’ or ‘willing’ to travel in April 2021, which is up a little from March 2021 (33%), but…

• Corporate air travel ticket sales there are still 76% down on 2019 levels; which is even greater than leisure travel sales (-52%) and online sales (-19%)

• While those business travellers with ‘no confidence’ in flying has reduced from more than 30% six months ago to less than 10% now, the ratio of those being ‘concerned or ‘very concerned’ about flying has actually increased (see the chart below, to the right)

US: business travel confidence in travel, October 2020 to April 21, 2021

• Lufthansa expects corporate travel to go back to 80% of 2019 levels only in 2024, and SME owners and employees to start travelling first – but they are not the ones with the big bucks; they travel in economy/coach on low-priced tickets

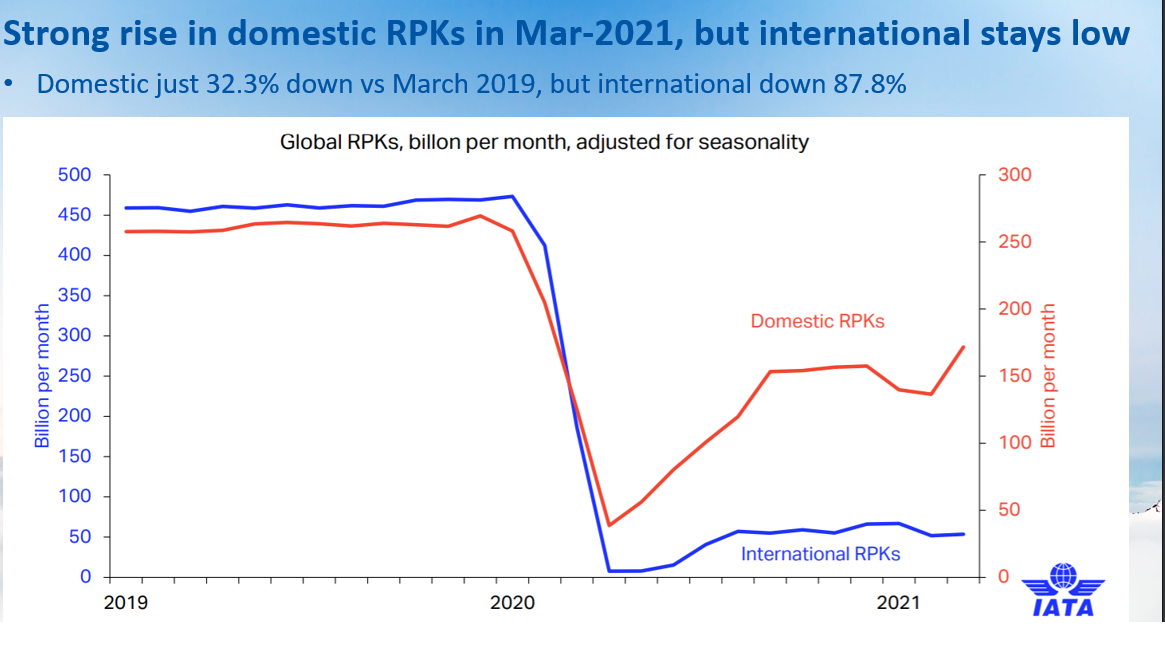

• While there was a rise in domestic RPKs in March 2021 they are still down by almost 88% compared to March 2019

IATA: global (domestic and international) RPKs, adjusted for seasonality, 2019-2021

“I wouldn’t invest in the airline business” – Warren Buffet

• Warren Buffet, CEO of Berkshire Hathaway and probably the world’s most famous investor, said on May 1, 2021 at a shareholder’s meeting, “I still wouldn’t want to buy the airline business internationally. People really want to travel for personal reasons but business travel is another thing.”

Who wants to pay a sick tax?

So the prospects for business travel are anything but rosy, and considerable responsibility is going to fall on airline business developers and marketers to attract leisure travellers back, and in great numbers.

But how can they do that with these additional COVID-related costs? And who wants to pay a ‘sick tax’ anyway? Especially if you aren’t sick.

It is more than likely that families will opt for one main foreign holiday each year in the immediate future; that could well be in the off-peak season and it might not be the main holiday either, merely a breather.

That might help redistribute income for airlines, airports and the travel industry – a small benefit. But then what happens if other countries follow the pattern in the UK, where there was no upsurge in foreign vacation booking when the government announced it would probably relax some travel restrictions from the week commencing May 17, 2021?

(Ultimately just 12 countries were put on the UK’s ‘green’ list, including the Falkland Islands, which occasioned some mirth in the UK press.)

The rush to book ‘staycations’ in the UK could spread faster than the virus

Instead of booking foreign holidays, there was a rush instead to ‘staycations’, and the UK is small enough that you can get just about anywhere without being required to fly.

Moreover, a growing trend of a preference for domestic vacations was observed, with possibly a short break abroad later in the year, depending on developments. If that became the norm, there would be no return to ‘normality’ in the foreseeable future.

Mr Walsh went on to say: “As travel restrictions are lifted in domestic markets, we are seeing strong demand. The same can be expected in international markets. But that could be perilously compromised by testing costs – particularly PCR testing. Raising the cost of any product this significantly will stifle demand. The impact will be greatest for short haul trips (up to 1,100 km); with average fares of USD105, the tests will cost more than the flight. (And it is already the case that travel taxes can be as high as the airfare). That’s not what you want to propose to travellers as we emerge from this crisis. Testing costs must be better managed. That’s critical if governments want to save tourism and transport jobs; and avoid limiting travel freedoms to the wealthy.”

The WHO International Health Regulations stipulate that states should not charge for testing or vaccination required for travel, or for issuing certificates.

The WHO COVID Emergency Committee recently reiterated this position, calling on governments to reduce the financial burden on international travellers of complying with testing requirements and any other public health measures implemented by countries.

“Testing costs should not stand between people and their freedom to travel”, said Mr Walsh. “The best solution is for the costs to be borne by governments. It’s their responsibility under WHO guidelines. We must not let the cost of testing – particularly PCR testing – limit the freedom to travel to the rich or those able to be vaccinated. A successful restart of travel means so much to people – from personal job security to business opportunities and the need to see family and friends. Governments must act quickly to ensure that testing costs don’t stall a travel recovery.”

The prospects of governments picking up this tab are woefully low

But realistically, does Mr Walsh or anyone else in the business have any hope of governments actually doing that?

Taking the UK as an example (as Mr Walsh was previously CEO of IAG, which includes British Airways), in late March 2021 a report was released by the Office for Budget Responsibility, which predicted that borrowing would hit a peacetime high of GBP355 billion in 2020-21 – equivalent to nearly 17% of GDP.

Even though this is down from a ‘worst case scenario’ of GBP394 billion, and well shy of the USD6 trillion plus (and counting) being committed to ‘recovery’ in the U.S, and is expected to fall to GBP234 billion in 2021-22, and then down to GBP107 billion the year after – it is extremely unlikely that the British government would be prepared to cover the cost of virus tests for travel at an average cost of GBP107 per passenger each way when it won’t even reduce the air travel duty (APD) by GBP1.

The UK government is even putting the APD up for long haul business travel, placing even further impediments in the way of executives who don’t want to travel in the first place.

Too many reasons not to travel

So, that is the position facing the travel industry in many countries as we approach the halfway stage of the second quarter of 2021, with international travel becoming ever more like the sort of hallucinatory dream Arnold Schwarzenegger had in ‘Total Recall.’

There are still precious few countries open to international travel. They can quite quickly be shut down again, throwing any plans air travellers have into disarray; and whether or not they have been ‘jabbed’, there is no guarantee of immunity. Even if there was, they are still going to have to pay through the nose for the privilege of being ‘tested’ before setting foot in someone else’s country to help tourist businesses impoverished by the coronavirus pandemic.

And as well, charges are going up in Spain

And to add insult to injury – some countries are having to face up to a hike in charges as well.

In Spain (where the ‘State of Alarm’ is being lifted) the national airport operator AENA (part state, part privatized, part stock market floated) has proposed to increase user charges at the 46 airports it operates across Spain.

Mr Walsh was quick to point out how this could damage Spain’s economic and employment recovery from COVID-19.

The proposals presented to the DGAC (the regulator) for approval include a request to increase charges by 5.5% over five years. They would also open the door for AENA to recover its lost revenues due to the COVID-19 crisis, for services which were never operated, or services that airlines couldn’t access.

Mr Walsh’s response to this is: “The whole aviation industry is in crisis. Everybody needs to reduce costs and improve efficiency to repair the financial damage of COVID-19. Having analysed AENA’s situation, airlines believe that AENA could reduce its charges by 4%. So proposing to pass the burden of financial recovery on to customers with a 5.5% increase is nothing short of irresponsible. The DGAC should immediately reject the request and instruct AENA to work with the airlines on a mutually agreed recovery plan.”

He laid out some statistical detail to support his position.

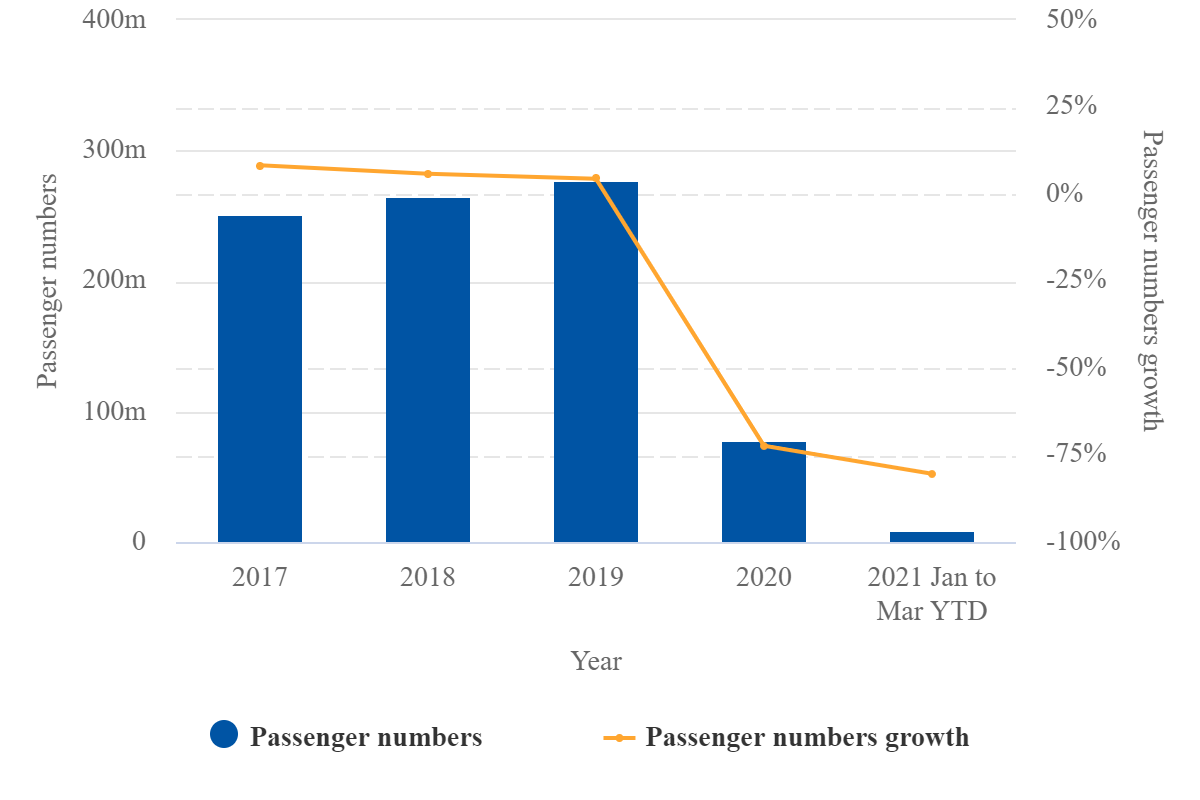

In Spain:

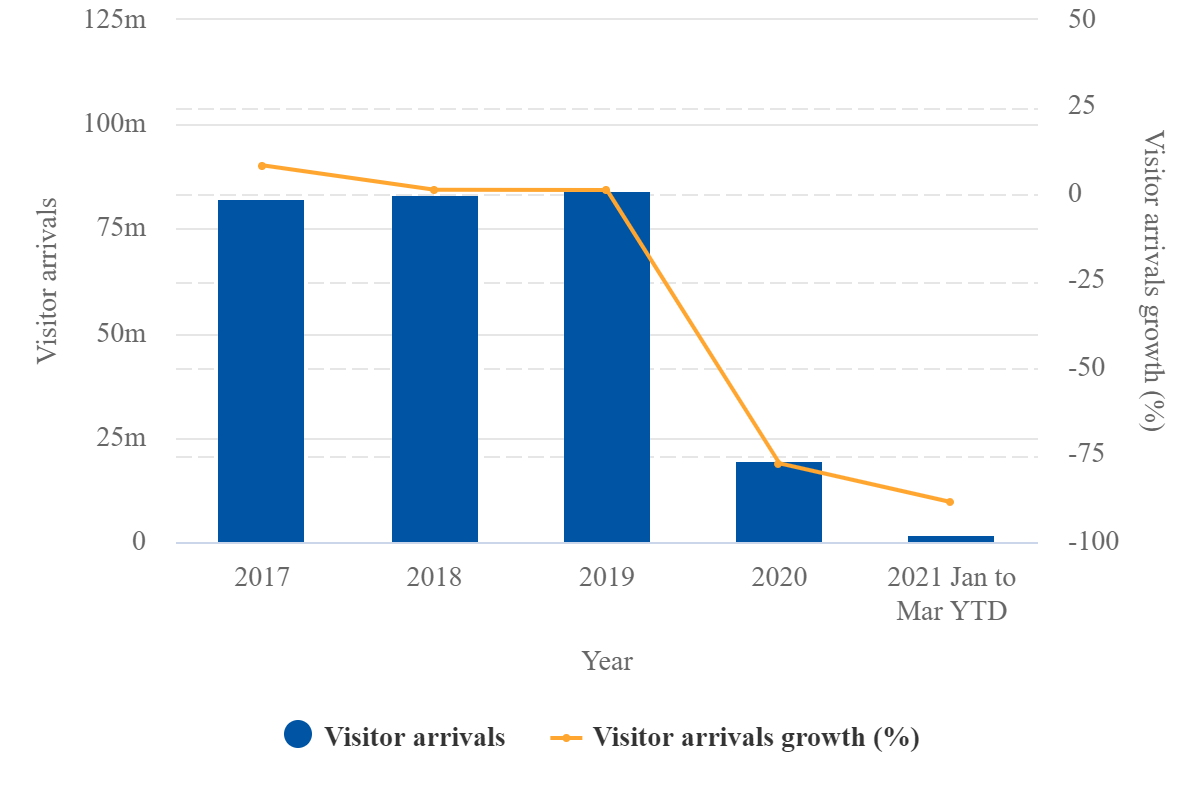

• Passenger demand declined by 76% in 2020 and is not expected to recover fully until 2024

• The number of cities with direct links to Spain fell from 1,800 (2019) to 234 (2020)

• More than 1.1 million Spanish jobs have been lost or put at risk, and more than EUR60 billion of GDP has been lost

• The contribution of travel and tourism to Spain’s economy fell from 12% to 4%

AENA Aeropuertos S.A. (ENAIRE): annual passenger numbers, 2017-2021

Mr Walsh added: “Pre-pandemic, AENA declared EUR2.59 billion of dividends over the 2017-19 period, and it has several options to cover its losses. AENA can easily finance short-term losses without increasing costs to its customers. It has an excellent credit rating to access financing. Its shareholders have been well-rewarded and must now share some of the pain. And, like the rest of the industry, it must look at operational efficiencies to lower costs, which are by no measure the cheapest in Europe.”

Private airport shareholders must recognize the severity of the situation and take some pain

While CAPA has usually been a proponent of airport privatization, arguing that there are more benefits than dis-benefits, the current position is one that will test the resolve of many of its supporters.

AENA was historically a supporter of ‘the common man’, as was Iberia, with very low, subsidized domestic airfares to help keep what was a largely impoverished population outside the capital until the late 1970s in touch with each other.

AENA argued strongly, and successfully, against centralization and in favour of keeping barely used airports open after privatization (by privatizing Madrid and Barcelona airports separately), and has always been a counterweight to its private sector shareholders (which are not of the aviation fraternity) where increases in charges are concerned.

Until now, that is. The points Mr Walsh makes are good ones, and the private sector – as well as the public one in AENA – need to be prepared to make sacrifices in the short term so that the long term benefits can be realized.

As Mr Walsh says, “An early recovery in travel and tourism is vital for Spain’s economic success. But higher costs will delay a tourism rebound and keep jobs at risk. AENA should keep in mind the long-term interests of both its shareholders and the country. And both are better served with cost-efficient airport infrastructure. The Spanish government is actively looking to open borders and restart air travel. AENA needs to contribute to that effort, not erect a short-sighted and self-interested roadblock.”

Spain: annual tourism, arrivals from 2017 to 2021

Is air travel being lined up for elimination?

In short, these COVID test charges could be the final straw, the ones that break the camel’s back, or whatever other idiom you care to use.

They also add even more fuel to the conflagration that is erupting in many countries as to what the ‘true’ nature of the pandemic is, and especially how it ties in with the economic ‘Great Reset’ (not a conspiracy theory, it is there for anyone to read in the literature of the World Economic Forum).

Air Transport is far from being on a recovery trajectory. The way things are right now, either directly or (mainly) by way of government incompetence, it is just digging itself even deeper in the mire.

More Travel News:

Marriott International files lawsuit to combat fraudulent robocalls

Margaritaville Beach Resort Nassau set to open July 2021

EU takes big step toward relaxing travel for vaccinated

Meet Private Chef Seth Saheli from My St. Kitts!