Where travel agents earn, learn and save!

News / European airlines: 3Q2021 capacity over 50% of 2019 would be positive

Europe has 14.2 million seats vs 35.4 million in 2019

June 8 - One month before the start of 3Q2021 – peak summer for Europe – seat capacity for the quarter is at 74% of 2019’s (based on OAG schedules and CAPA Fleet Database seat configurations). This would be a very rapid recovery from 1Q2021 (27%) and 2Q2021 (34% projected with one month left).

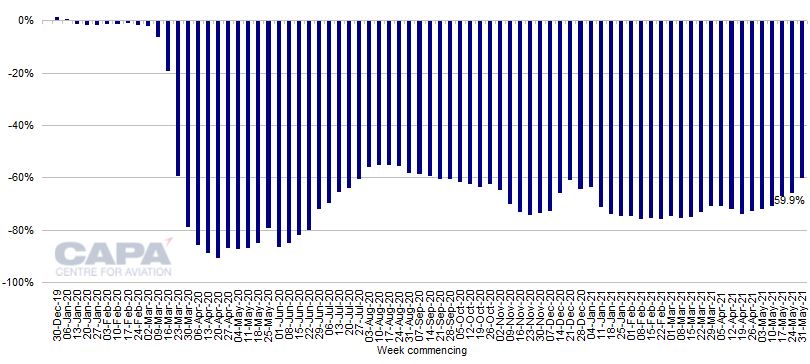

Seat capacity in Europe is 59.9% below 2019 in the week commencing May 31, 2021. This continues the positive trend into a sixth successive week, during which the rate of fall has narrowed by 13.7ppts. This is Europe’s slowest rate of decline versus 2019 since September 2020.

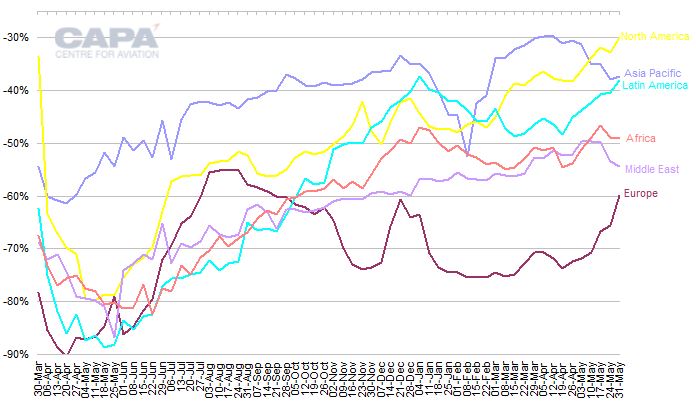

Europe is narrowing the gap to the other regions: Middle East seat capacity is down by 54.4% versus 2019, while Africa is down by 49.1%, Latin America by 38.0%, Asia Pacific by 37.4%, and North America by 30.0%.

In previous quarters during the coronavirus pandemic capacity has fallen by approximately a half from one month out to the eventual outcome.

Of course, 3Q2021 seat count will be driven by progress on travel restrictions. However, extrapolation of the pattern of previous quarters suggests that 3Q2021 capacity at more than 50% of 2019 would be a positive outcome.

Europe has 14.2 million seats vs 35.4 million in 2019 – down 60%

In the week commencing May 31, 2021, total European seat capacity is scheduled to be 14.2 million, according to OAG schedules and CAPA seat configurations.

This is 59.9% below the 35.4 million seats of the equivalent week of 2019. It is the 63rd week of very heavy double digit percentage (more than 50%) declines in seats versus 2019.

Nevertheless, this is 5.6ppts better than the 65.5% fall a week ago, and the sixth consecutive week of narrowing capacity reductions versus 2019. There has been a 13.7ppt improvement over that period.

This week’s total seat capacity for Europe is split between 5.9 million domestic seats, versus 8.2 million in the equivalent week of 2019; and 8.3 million international seats, versus 27.2 million.

Europe’s domestic seats are down by 28.7% versus 2019 (the narrowest fall since August 2020), compared with last week’s -36.4%.

International seat capacity is down by 69.4% versus 2019, compared with last week’s -74.2%.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019

Europe is closing the gap to other regions

Europe's 59.9% cut in seat numbers is 5.6ppts adrift of the next deepest, Middle East, which is down by 54.4% from 2019 seat capacity this week. This gap has narrowed from last week's 12.2ppt difference.

Africa’s seat count is down by 49.1%, Latin America’s by 38.0%, Asia Pacific’s by 37.4%, and North America’s by 30.0%.

Europe, North America, Asia Pacific and Latin America have taken upward steps in the trend of seats versus 2019 levels this week. Africa is broadly flat on last week’s level, whereas Middle East has taken a downward step.

Percentage change in passenger seat capacity vs 2019 by region, week of March 30, 2020 to week of May 31, 2021

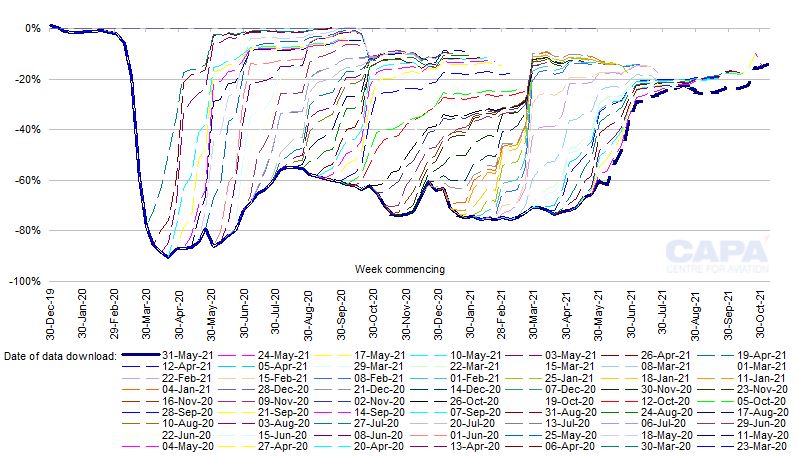

Projected Europe capacity for 3Q2021 is still at 74% of 2019

Based on airline schedules filed with OAG and CAPA seat configuration data, scheduled capacity for Europe in 2Q2021 is down by another 3% from last week and is now projected to be down by 66% from 2019 levels (i.e. at 34% of 2019 levels, compared with 27% for 1Q2021).

Schedules for 3Q2021 have also been trimmed by 3%, with seat numbers for the quarter now planned to be down by 26% versus 2019. This is still 74% of 2019 – back to the level projected for 3Q in late April 2021.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019, with outlook at different dates*

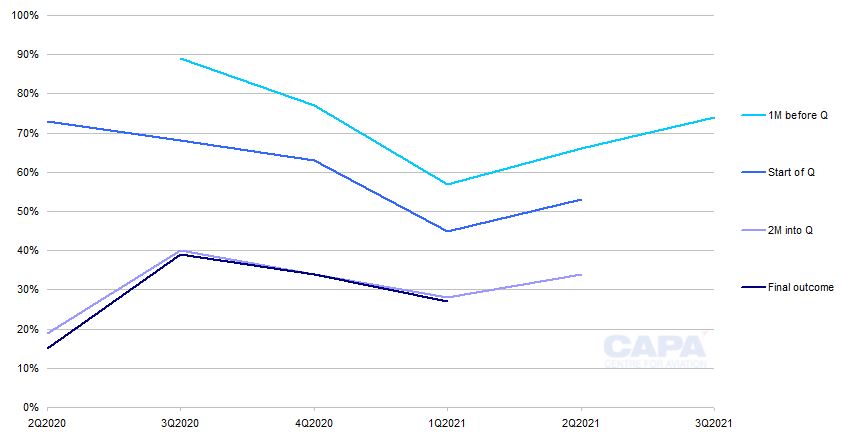

Capacity in previous quarters has fallen by c50% from what was scheduled one month before

At the equivalent stage of 2020 – that is, one month before the start of 3Q – capacity for 3Q was projected at 89% of 2019 levels. By the time the quarter began, this had been cut to 68%. The final outcome was that 3Q2020 was at only 39% of 2019 levels.

One month before the start of 4Q2020, capacity for the quarter was projected at 77% of 2019 levels. By the time the quarter began, this had been cut to 63%. The final outcome was that 4Q2020 was at just 34% of 2019 levels.

One month before the start of 1Q2021, capacity for the quarter was projected at 57% of 2019 levels. By the time the quarter began, this had been cut to 45%. The final outcome was that 1Q2021 was at 27% of 2019 levels.

One month before the start of 2Q2021, capacity for the quarter was projected at 66% of 2019 levels. By the time the quarter began, this had been cut to 53%. The final outcome for 2Q2021 is not yet known, but (as noted above) it is currently projected at 34% of 2019 levels.

In previous quarters during the pandemic there has been little further movement in capacity derived from schedules in the final month of the quarter.

However, capacity for each of the past three full quarters has been cut by approximately a half from what was projected one month before the start of the quarter to the final outcome. This reduction was 55% for 3Q2020, 56% for 4Q2020 and 52% for 1Q2021.

Europe: projected seat capacity as a percentage of equivalent quarter of 2019 one month before quarter start, at quarter start and two months into the quarter, with final outcome

More than 50% of 2019 seat capacity in 3Q2021 would be a positive outcome

There is nothing inherent in the data, or the way in which the recovery might progress, to say that these patterns have to be repeated in 2Q2021 and 3Q2021. Capacity will be driven by the loosening of travel restrictions.

However, purely based on extrapolation of these trends, 2Q2021 capacity should end up at more than 30% of 2019 levels, reversing the falling trend of previous quarters, and 3Q2021 may be somewhere between 40% and 50% of 2019’s.

This would be similar to the best month of the pandemic so far for capacity in Europe, which was August 2020, when seat numbers reached 45% of 2019 levels.

The outcome for 3Q2021 – the peak summer period in Europe – could be improved by further relaxation of international travel restrictions.

However, the currently projected 74% of 2019 is almost certainly too high.

If European seat capacity averages more than 50% of 2019 levels in 3Q2021, that for the quarter would be a positive outcome from today’s standpoint.

More Travel News:

Apptopia, Braze, and Skyscanner release trends and predictions for Travel and Hospitality industry

U.S travel to Europe – A summer revival?

Hilton inspires guests to create new eco-conscious travel memories

“The planet we love”, the Meliá project getting customers involved in combatting climate change