Where travel agents earn, learn and save!

News / European aviation. International travel restrictions ease; more needed

Changes in travel restrictions have a big impact on demand

July 15 - The prospects for the third quarter, the most important for European airline revenue, look better in 2021 than in 2020. Forward bookings are up and 3Q2021 seat numbers are planned at 70% of 3Q2019, compared with 3Q2020 at 39%.

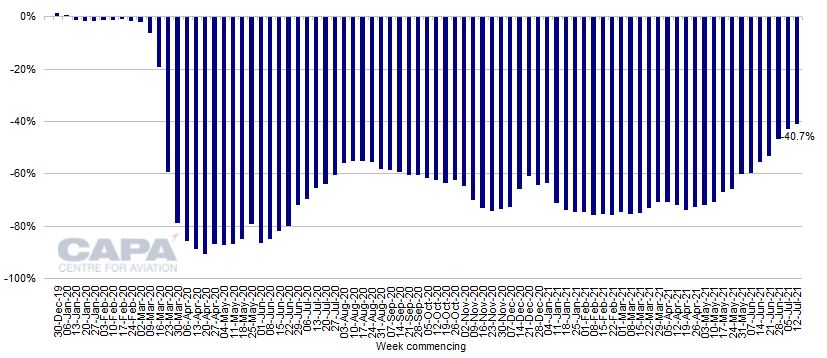

Europe’s capacity recovery continues in the week commencing July 12, 2021, but is not yet at the 70% of 2019 scheduled for 3Q. Seat numbers are 40.7% below the equivalent week of 2019, after -42.7% last week. This is above 50% of pre-pandemic levels for a third successive week.

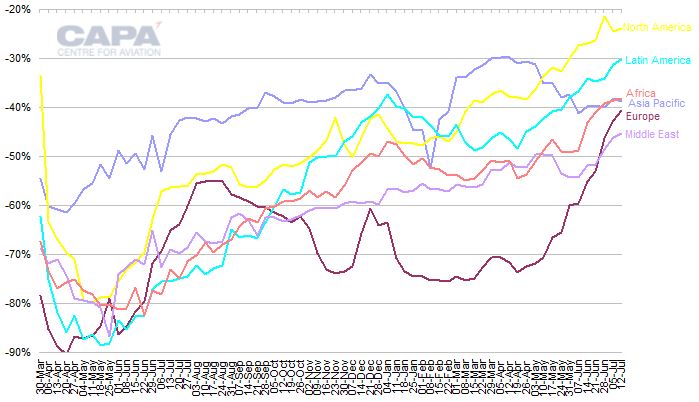

After eight months as the worst performing region on this measure, Europe has now had three weeks above the Middle East, where seat capacity is down by 45.4% versus 2019. This week (week commencing July 12, 2021), Asia Pacific is down by 38.7%, Africa by 38.1%, Latin America by 30.3%, and North America by 23.9%.

The further relaxation of international travel restrictions will determine the pace of the recovery as 3Q2021 unfolds. There has been recent progress, both in the EU and the UK, but more is needed to restore international travel in full.

Europe has 21.9 million seats vs 36.9 million in 2019 – down 41%

In the week commencing July 12, 2021, total European seat capacity is scheduled to be 21.9 million, according to OAG schedules and CAPA seat configurations.

This is 40.7% below the 36.9 million seats of the equivalent week of 2019, only the third time in 69 weeks that the decline has been less than 50%, and 2.0ppts better than the 42.7% fall a week ago (week commencing July 5, 2021).

This week’s total seat capacity for Europe is split between 7.3 million domestic seats, versus 8.0 million in the equivalent week of 2019; and 14.6 million international seats, versus 28.9 million.

Europe’s domestic seats are down by only 9.4% versus 2019, compared with last week’s -11.3%.

International seat capacity is down by 49.4% versus 2019, compared with last week’s -51.5%. This is the first time that international capacity has risen above 50% of the equivalent week of 2019.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019, week of December 30, 2019 to July 12, 2021

Europe remains second weakest region by percentage of 2019 seats

The Middle East is the worst performing region for the third week running, having replaced Europe at the bottom two weeks ago.

Middle East seat capacity is down by 45.4% versus 2019 this week, compared with Europe’s 40.7% cut in seat numbers.

Asia Pacific’s seat count is down by 38.7%, Africa’s by 38.1%, Latin America’s by 30.3%, and North America’s by 23.9%.

Europe, Latin America, North America and Middle East have taken upward steps in the trend of seats versus 2019 levels this week, while Asia Pacific and Africa are broadly stable on last week.

Europe’s 2.0ppt improvement from last week is the biggest gain of all regions this week.

Percentage change in passenger seat capacity vs 2019 by region, week of March 30, 2020 to week of July 12, 2021

Europe's 3Q2021 schedules project capacity at 70% of 2019 levels

According to data from OAG and CAPA, scheduled seat capacity for Europe improved from 27% of 2019 levels in 1Q2021 to 34% in 2Q2021.

Schedules for 3Q2021 – historically the busiest quarter for Europe’s airlines – have been trimmed by just over 1% since last week. Seat numbers for the quarter are now planned to be 70% of 2019 levels.

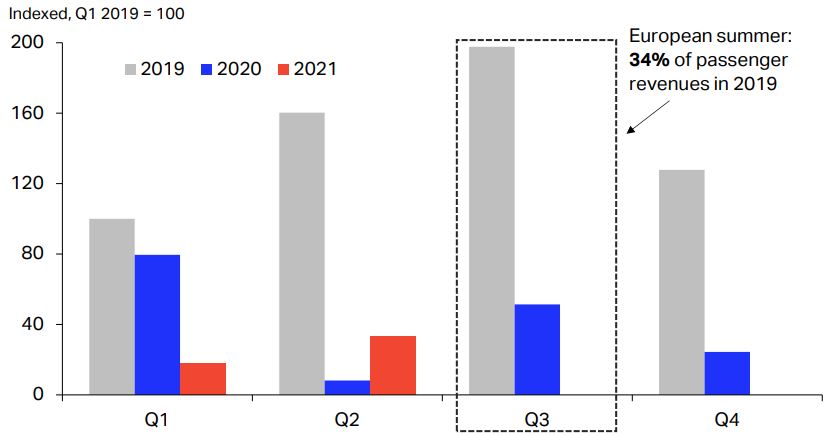

The third quarter is the most important for European airline revenue

As illustrated by the IATA chart reproduced below, 3Q is the most important quarter for European airline revenues.

In 2019, the last full year before the pandemic, 3Q accounted for 34% of annual passenger revenues (excluding ancillaries and surcharges). 3Q2019 generated twice the passenger revenue of 1Q2019, almost 25% more than 2Q2019, and approximately 60% more than 4Q2019.

The pandemic had a devastating impact on passenger revenues for European airlines in 2020, with almost no revenue in 2Q2020 and a 75% year-on-year reduction in the vital 3Q2020.

According to IATA at July 9, 2021, bookings for intra-European travel indicate that summer 2021 should be better than summer 2020.

Passenger revenues* - within Europe

Capacity plans projected by current schedules also reflect this anticipated improvement. As noted above, 3Q2021 seat numbers are planned at 70% of 3Q2019, compared with 3Q2020 capacity at just 39%.

The outturn for the all-important peak summer quarter in Europe will depend on further relaxations in international travel restrictions.

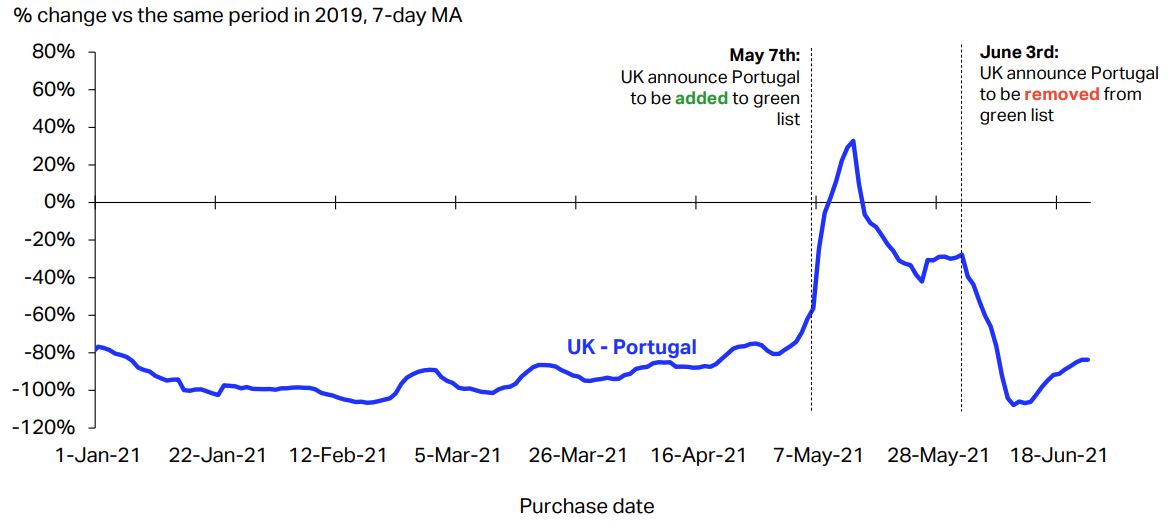

Changes in travel restrictions have a big impact on demand

The impact of changes in travel restrictions on demand for travel tends to be rapid and very significant.

According to IATA Economics, using data from DDS, forward bookings for travel from the UK to Portugal surged from around 80% below 2019 levels to 40% above 2019 levels over a period of two weeks when Portugal was added to the UK green list in May 2021.

After Portugal was removed from the green list, bookings fell to more than 100% below 2019 levels (see chart below).

Forward bookings: UK-Portugal travel

European international travel restrictions have eased somewhat…

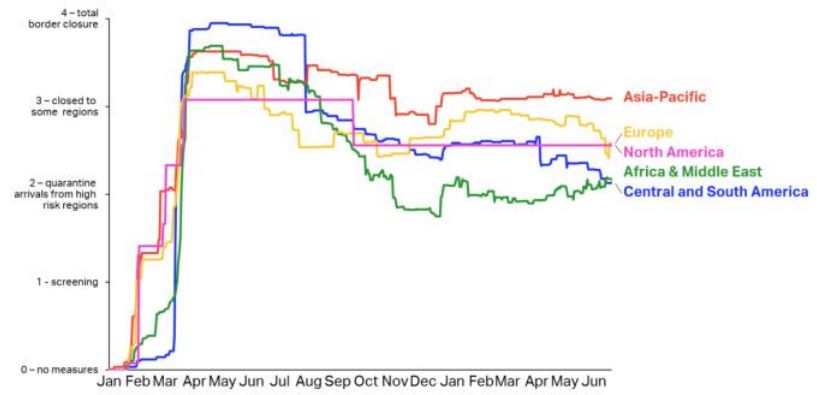

Europe has the second highest stringency of international air travel measures after Asia Pacific (at June 2021), according to IATA Economics /Oxford University. Moreover, the level has been more volatile in Europe than in Asia Pacific and North America.

Nevertheless, Europe has enjoyed a reduction in stringency in recent weeks.

Stringency of government international air travel measures

…and are easing further in the EU…

Moving into July 2021, European restrictions are experiencing some further relaxation.

The European Union Digital COVID Certificate system started on July 1, 2021. Some EU member states delayed its introduction, but all should be on board by the time Ireland switches its participation on, from July 19, 2021.

This should facilitate quarantine-free travel between EU member states for passengers that are fully vaccinated.

…and in the UK

In addition, on July 8, 2021 the UK announced plans to allow quarantine-free travel to amber list countries for fully vaccinated residents (and children) of England from July 19, 2019.

The recommendation for people not to travel to amber list countries will also be removed from the same date.

For fully vaccinated residents (and children), this makes amber list countries equivalent to green list countries.

This opens up international travel to more than 140 amber list countries and territories, including most European destinations (apart from Turkey) and the US, in addition to the 27 green list countries and territories.

However, as with green list countries, travellers will still need to take tests pre-departure and on arrival back in England. The cost of tests is likely to remain a barrier to international travel for more price sensitive travellers.

More is needed to restore international travel in full

These most recent moves in the EU and the UK are welcome steps towards further relaxation of international travel restrictions in Europe. The crucial 3Q2021 travel period should be much better than the equivalent period of 2020.

However, it seems likely that until progress with vaccination programmes is more uniform globally, there will continue to be inconsistencies in approach between different countries.

Consequently, it is too soon to declare that a full return of international travel has arrived.

More Travel News:

IATA calls on states to follow WHO guidance on cross-border travel

Four Seasons invites travellers to reconnect with the world: From wanderlust to wandermust

Delta recognized as ‘Best Places to Work for Disability Inclusion’ for sixth year running

Delta to add Airbus, Boeing aircraft to fleet amid travel demand recovery