Where travel agents earn, learn and save!

February 27 2026 / 01:10 AM

News / Summer means more debt

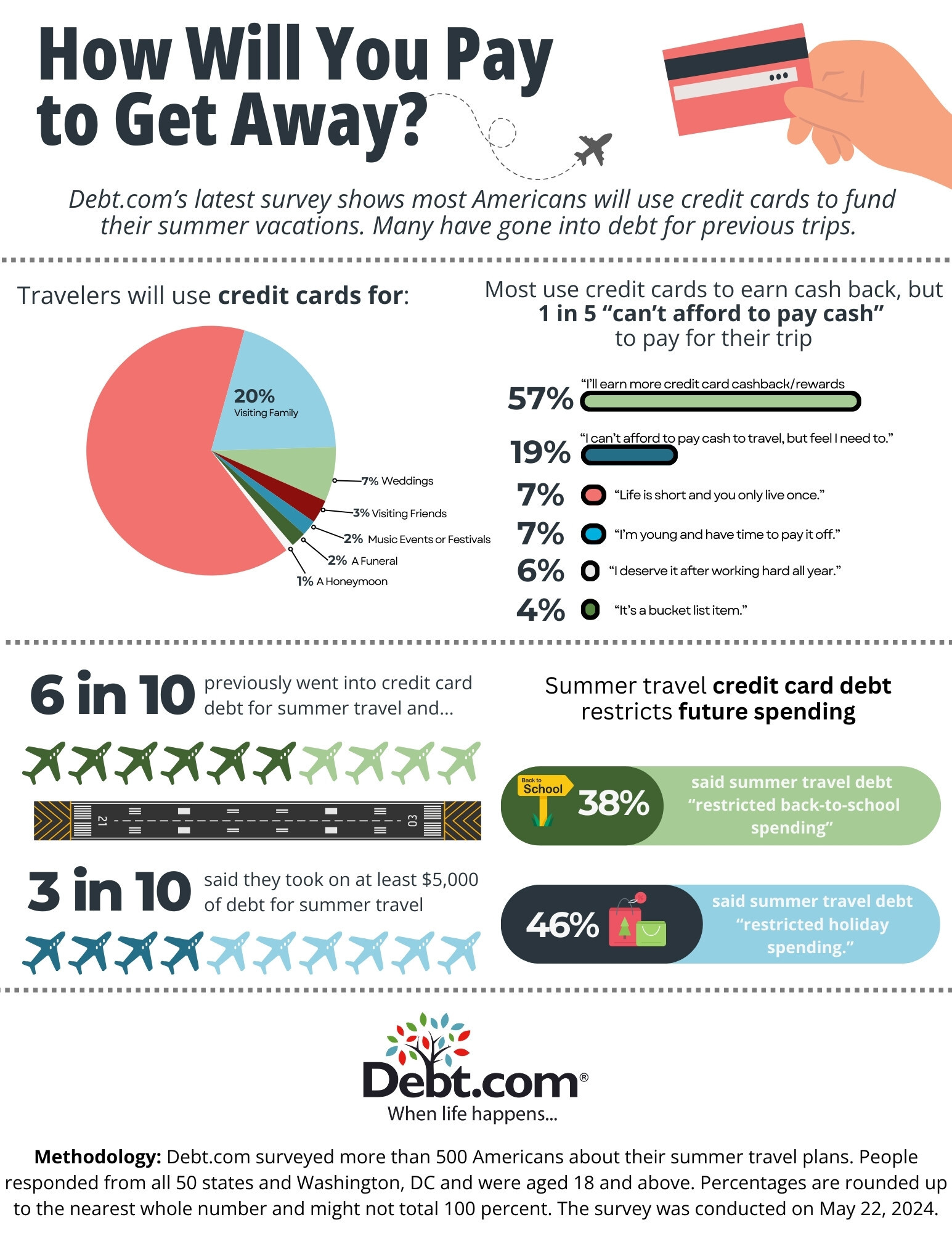

8 in 10 Travelers will use credit cards to get away

When Americans travel this summer, most will put those travel expenses on their credit cards – and more than a quarter (30%) will charge at least $5,000.

A new Debt.com survey shows 83% will pay for their trip using credit cards. More than half (56%) say they'll earn cashback and rewards, while 19% can't afford to pay cash, but still feel the need to get away this summer. For many, this is a recurring practice.

Just under 3 in 5 (59%) have gone into debt for summer travel in the past. That includes 66% of Gen X, 64% of Millennials, 47% of Baby Boomers, and 34% of Gen Z.

One result stands out to Debt.com President Don Silvestri.

Other key takeaways:

- Of the summer travelers who will use credit cards to pay for a vacation, 7% plan to charge $15,000 or more

- Out of the people who will finance their vacation with credit, 25% of Gen X and 18% of Millennials say it's because they can't afford to pay cash

- Of those who have previously gone into credit card debt for summer travel, 66% are Gen X, with 64% of Millennials

- Of the 46% of respondents who say summer travel debt later restricted their holiday spending, more than half (57%) are Gen X, 47% are Millennials, 46% are of Gen Z, and 22% are Baby Boomers.

Advice for a summer vacation that won't break the bank:

- Set a Budget: Before planning your trip, determine how much you can afford to spend without incurring debt. Include all potential expenses such as transportation, accommodation, food, activities, and souvenirs.

- Use Rewards Wisely: If you plan to use credit cards, take advantage of cashback and reward points. However, ensure you can pay off the balance in full when the bill arrives to avoid interest charges.

- Prioritize Expenses: Identify what's most important for your vacation experience and allocate more of your budget there. Cut back on less critical expenses.

- Stay Local: Explore nearby destinations that can provide a great vacation experience without the high costs associated with long-distance travel.

- Be Flexible: Travel date flexibility can help you find better deals on flights and accommodation. Use fare comparison tools and alerts to get the best rates.

- Avoid Impulse Purchases: Stick to your budget and avoid spur-of-the-moment purchases. Set aside a small allowance for spontaneous spending, and once it's gone, avoid further unplanned expenses.

Jun 12, 2024