Where travel agents earn, learn and save!

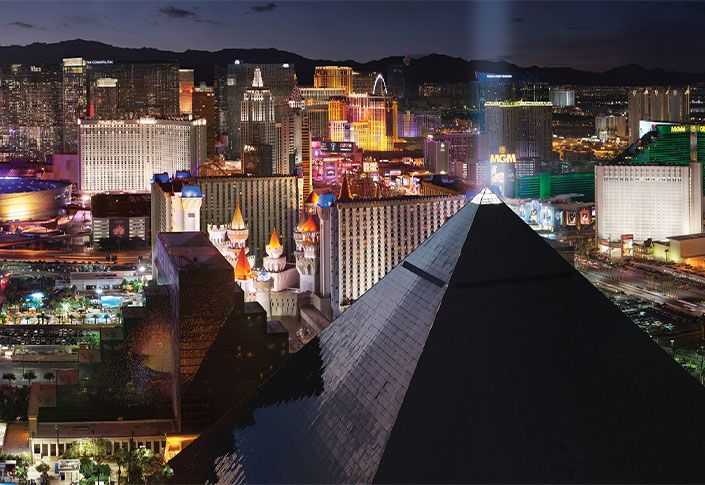

News / MGM Resorts International addresses financial impact of COVID-19

The top priority is the health and safety of employees, guests, and communities

In light of the material unforeseen and unprecedented volatility in the financial markets, MGM Resorts International is providing the following update on its results for the first two months of the year, the impact of COVID-19 on its operations and an overview of the steps it is taking to help minimize the financial impact.

Mr. Hornbuckle further addressed the state of the business in a video message to employees which can be found on the MGM Resorts website.

Operations Update

Since March 16, 2020, all of the Company's domestic properties have been temporarily closed to the public and the Company has also experienced very high group cancellations. This is an unprecedented public health crisis and the Company believes that it must do all it can to assist in mitigating the impact of the epidemic to protect the health and safety of its employees, guests and the communities in which it operates.The Company will continue to cooperate with local health officials to assist in accelerating the containment of the COVID-19 pandemic.

In addition, while the Company’s Macau properties are now open, visitation remains at low levels and travel constraints continue to impact the market.

Business Performance Update

The Company's domestic operations had a strong start for the first two months of 2020:

• Consolidated net income attributable to MGM Resorts was approximately $1.3 billion for the first two months of 2020, up significantly from approximately $27 million for the first two months of 2019, primarily driven by an approximately $1.5 billion pre-tax gain related to the MGM Grand/Mandalay real estate transaction

• Consolidated net revenues were down 10% compared to the prior year two-month period, driven by weaker visitation at the Company’s properties in Macau following news of the coronavirus and the closures of such properties for a 15-day period in February

• Las Vegas Strip Resorts Adjusted Property EBITDAR was up 24%, or 27% on a same store basis excluding Circus Circus Las Vegas, compared to the prior year two-month period

• Regional Operations Adjusted Property EBITDAR was up 42%, or 26% on a same store basis excluding Empire City and MGM Northfield Park, over the prior year two-month period

The Company has since incurred substantial operating losses in March and the Company does not expect to see a material improvement until more is known regarding the duration and severity of the pandemic, including when the Company’s properties can re-open to the public.

Expense and Cash Flow Reduction Efforts

The Company is making swift decisions to significantly reduce expenses to protect its financial position. The Company estimates that 60-70% of its domestic property level operating expenses are variable and is undertaking a thorough review to significantly minimize these costs, such as the implementation of hiring freezes, furloughs and other headcount reductions.The Company is also actively reviewing its fixed property level operating expenses and corporate expenses to identify opportunities to further drive expense reductions.

In addition, the Company is evaluating all capital spend projects and expects to defer at least 33% of planned 2020 domestic capital expenditures.

Balance Sheet Update

As of March 26, 2020, the Company, excluding MGM China and MGM Growth Properties LLC ("MGP") (the "MGM Resorts Domestic Operations"), had operating cash and cash investment balances of approximately $3.9 billion, including approximately $1.5 billion drawn under its revolving credit facility.MGM Resorts Domestic Operations has no debt maturing prior to 2022 and expects interest payments associated with its approximately $5.5 billion of debt outstanding as of March 26, 2020 to be approximately $200 million for the remainder of 2020.

Additionally, the Company has certain fixed rent payments for the remainder of 2020 of approximately $184 million and $219 million under its leases related to Bellagio and MGM Grand/Mandalay Bay, respectively.

The Company also has fixed rent payments under the master lease with MGM Growth Properties LLC (“MGP”) of $621 million for the remainder of 2020, or $333 million net of expected distributions of $288 million from MGP based on the current annualized dividend rate of $1.90 per share and the Company’s 60.64% economic ownership.

The Company has also entered into an agreement with MGP to receive cash for up to $1.4 billion of the Company’s existing operating partnership units, which the Company has not exercised.

Furthermore, as of March 26, 2020, MGP had operating cash and cash investment balances of approximately $1.8 billion, including $1.35 billion drawn under its revolving credit facility. In addition, MGP repaid approximately $1.7 billion of indebtedness during the first quarter of 2020.

For more information, please visit prnewswire.com

More Travel News:

Sunwing and Hola Sun have introduced new flexible policies

St. Kitts & Nevis takes further action against COVID-19

All Sandals and Beaches Resorts to shut down

Canada’s Quarantine Act now in effect